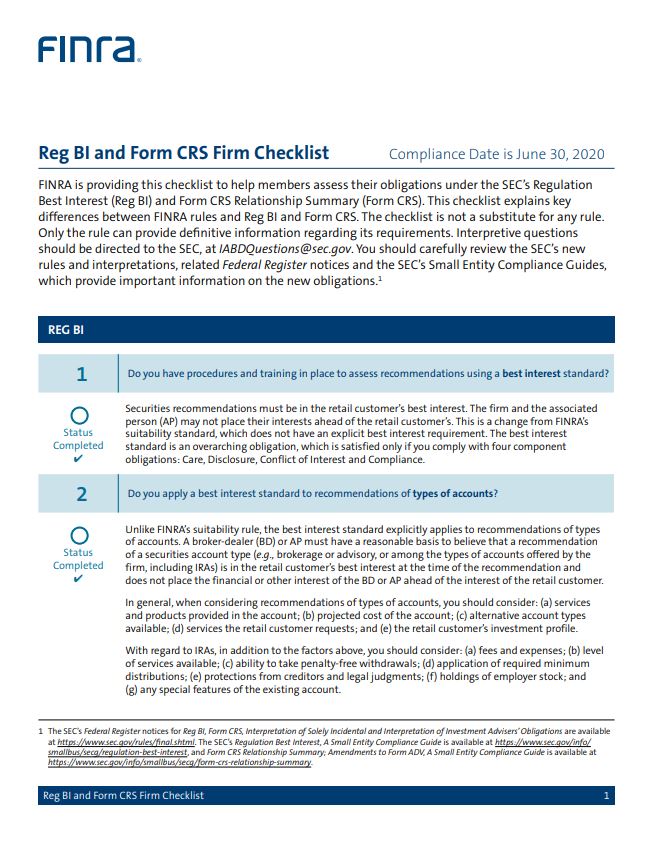

Firms and financial professionals affected must comply with Reg BI and Form CRS by June 30, 2020.

The SEC first adopted Regulation Best Interest (Reg BI) in 2019, releasing a series of new interpretations and additional requirements to existing securities legislation which had been in place for decades. As part of the rulemaking package, they adopted new forms and additional rules, including the requirement that broker-dealers, investment advisers and dually-registered financial professionals create and provide Form CRS to retail customers.

Regulators who will begin enforcing the legislation next month will want to know what policies and procedures firms have put in place to comply, and how they intend to supervise to make sure their staff members are in compliance.

Here are downloadable files from FINRA and SEC with pertinent information:

What Is Reg BI?

What Is Reg BI?

Reg BI establishes a “best interest” standard of conduct for broker-dealers when they make a recommendation to any retail customer. The SEC points out that the definition of “retail customer” does not exclude anyone, including high-net worth natural persons and natural persons that are accredited investors, and a retail customer may not waive best interest requirements.

Per FINRA, “Securities recommendations must be in the retail customer’s best interest. The firm and the associated person (AP) may not place their interests ahead of the retail customer’s. This is a change from FINRA’s suitability standard, which does not have an explicit best interest requirement. The best interest standard is an overarching obligation, which is satisfied only if you comply with four component obligations: Care, Disclosure, Conflict of Interest and Compliance.”

Per the SEC:

Regulation Best Interest expressly applies to account recommendations including recommendations of securities account types generally (e.g., to open an IRA or other brokerage account, or an advisory account), as well as recommendations to roll over or transfer assets from one type of account to another (e.g., from a workplace retirement plan account to an IRA).

There are many options or account types within brokerage accounts. For example, brokerage accounts can include: education accounts (e.g., 529 Plans and tax-free Coverdell accounts); retirement accounts (e.g., IRA, Roth IRA, or SEP-IRA accounts); and specialty accounts (e.g., cash or margin accounts, and accounts with access to Forex or options trading). Different brokerage accounts can also offer different levels of services, such as access to online trading, or can offer different products, for example in higher dollar amount accounts (e.g., access to products with break-points). [These] are just some examples of brokerage accounts that could be recommended to a retail customer, and to which Regulation Best Interest would apply.

The type of securities account recommended is an investment strategy that has the potential to greatly affect retail customers’ costs and investment returns. For example, different types of securities accounts can offer different features, products, or services, some of which may—or may not—be in the best interest of certain retail customers. Accordingly, the [SEC staff] reminds broker-dealers that the term “investment strategy” (which includes account recommendations) is to be interpreted broadly. Further, account recommendations will almost always involve a “securities transaction” (such as a securities purchase, sale, or exchange), and thus would generally be subject to Regulation Best Interest in any case.

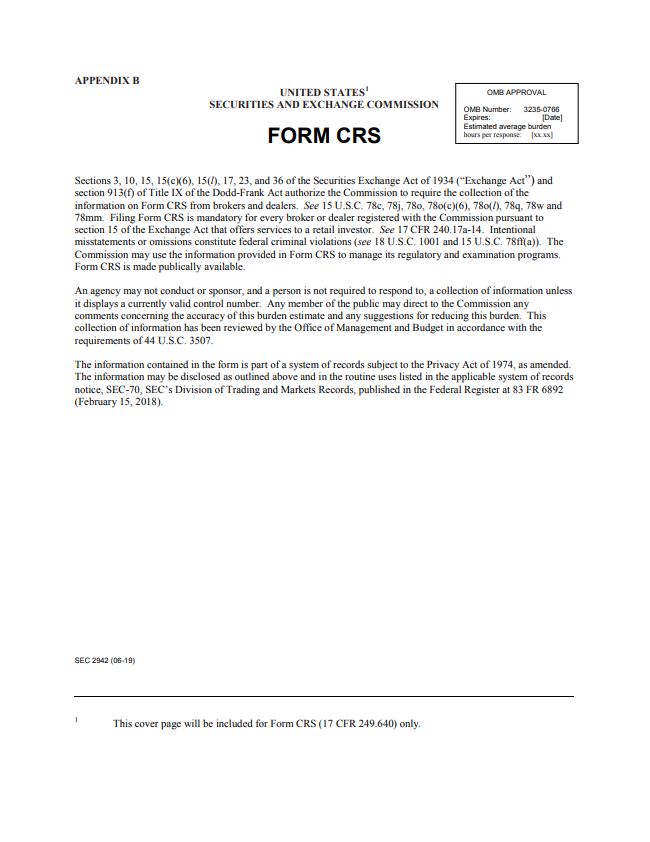

Form CRS

Firms that serve retail investors are required to both publicly file* and provide the Form CRS to prospective and existing clients. The required Form CRS provides a relationship summary to retail customers/investors. It must include your name, services provided, experience, licenses, education and what your qualifications mean. All fees, cash and non-cash compensation, third-party revenue sharing or compensation, and any potential conflicts of interest must be included. No material facts may be omitted.

In paper or PDF format, the Form CRS must not exceed two pages. Reasonable paper size, font size, and margins must be used. Form CRS should use “plain English” and should generally avoid legal jargon and technical business terms unless clearly explained. Easily-understood charts, graphs and links to calculators are encouraged.

*Filing information from the SEC:

“If you are an investment adviser and are required to deliver a relationship summary to a retail investor, you must file Form ADV, Part 3 electronically through IARD. Your relationship summary will be publicly disseminated through the Investment Adviser Public Database (“IAPD”).

“If you are a broker-dealer and are required to deliver a relationship summary to a retail investor, you must file Form CRS electronically through Web CRD®, operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”). Your relationship summary will be publicly disseminated through BrokerCheck.”

“If you are a dual registrant as defined under General Instruction 11 to Form CRS, you must file your broker-dealer relationship summary and your investment adviser relationship summary (whether prepared as a combined relationship summary or separate summaries) as Form ADV, Part 3 (Relationship Summary) through IARD. For filing purposes, a dual registrant will prepare one PDF file containing both its broker-dealer relationship summary and its investment adviser relationship summary (whether prepared as a combined relationship summary or separate summaries) and any applicable exhibit for purposes of filing.”

Here are some links you may find useful:

IARD

https://www.sec.gov/divisions/investment/iard.shtml

https://www.iard.com/sites/iard/files/standalonefiles/adv-part-3-crs.pdf

WEB CRD

https://www.finra.org/sites/default/files/2020-03/web-crd-form-crs-bd-only.pdf

GENERAL INFORMATION

https://www.sec.gov/investment/form-crs-faq

https://www.finra.org/sites/default/files/2019-10/reg-bi-checklist.pdf

The Difference Between FINRA and the SEC (Broker-Dealers versus RIAs)

From Investopedia:

- The Financial Industry Regulatory Authority (FINRA) handles the licensing and regulation of broker-dealers.

- FINRA is a not-for-profit entity that is not part of the government, although it has some regulatory powers.

- The Securities and Exchange Commission (SEC) is a government organization that is meant to protect investors and ensure the integrity of the securities market.

- The SEC oversees FINRA and acts as the first level of appeal for actions brought by FINRA.

FINRA does not regulate investment adviser (RIA) firms. Generally, larger RIAs with $100 million+ in assets under management (AUM) register with the SEC, while those with lower AUM usually register with the state/s they do business in.

While FINRA does not regulate RIAs, it does administer the online application and filing system for the registration of investment advisory firms and individual investment adviser representatives (IARs). This system is called the Investment Adviser Registration Depository (IARD) and handles all Form ADV and other related filings.

A hybrid or dually-licensed RIA firm may be regulated by both FINRA and the SEC (or relevant states) given that individuals at the firm may be serving as IARs of the advisory firm (overseen by the SEC or relevant state/s) while simultaneously serving as a registered representative of a broker-dealer firm (regulated by FINRA).

Who Can Call Themselves “Advisor” or “Adviser?”

Under Reg BI, the SEC clarified that broker-dealers may not call or refer to themselves “advisors” or “advisers” unless they are also registered as investment advisors with the SEC or are state-registered. Just being affiliated with an investment advisor is not enough. If the broker-dealer only provides advice to non-retail customers, such as municipal advisors, commodity trading advisors, or advisors to special entities, they will be allowed to continue to use the terms.

For those who will be in violation of this aspect of Reg BI as of June 30th, titles need to be changed on business cards and print and digital ads, as well as in written communication to clients, to name a few instances.

RIAs Already Have A Best Interest Standard

Although by implementing Reg BI the SEC intends to protect the consumer, some argue that they are actually confusing retail investors rather than helping them, since the mandate for recommending only what is in a client’s “best interest” has always been required of RIAs and registered investment advisers. Their licensing has always held them to a legal fiduciary standard.

Most RIAs are either fee-only or fee-based, meaning they are compensated by a disclosed percentage of any client assets under management rather than by commissions on securities trades. Some RIAs may also make a disclosed commission on certain products which are not securities, like life insurance policies and annuities; transparency has always been required for RIAs.

Critics of Reg BI say it doesn’t go far enough to protect consumers from conflicted advice, especially from dually-registered advisors. From the consumer’s perspective, the terms “fiduciary” and “best interest” may seem synonymous, but now they aren’t. Investors are being warned to be on their guard and ask financial advisors whether they are legally required to act as fiduciaries with every recommendation they make.

To complicate things further, on June 1, the Department of Labor, which oversees retirement plans like 401(k)s, issued a new rule to the Office of Management and Budget for review. The language of the new rule, called “Improving Investment Advice for Workers and Retirees Exemption,” hasn’t been made public yet as of this writing.

The CFP Board Is Also Changing Its Standards of Conduct

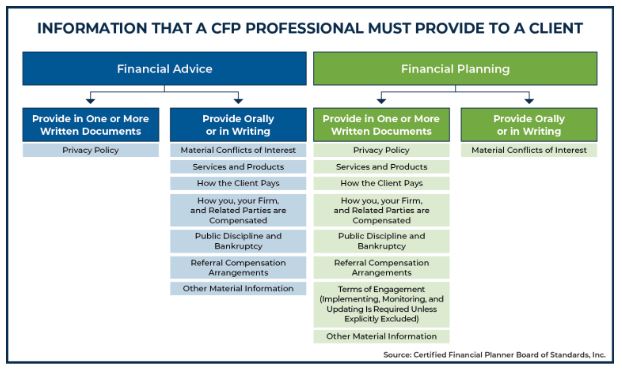

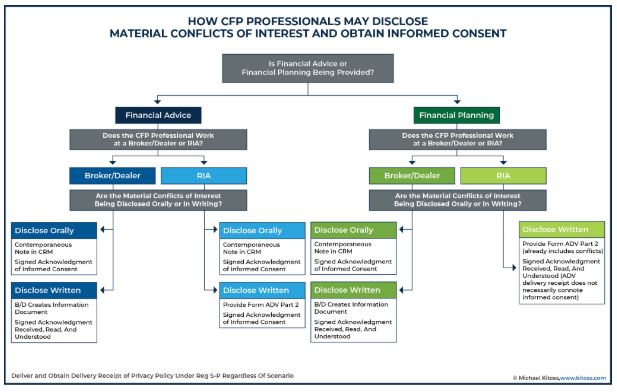

The CFP® (Certified Financial Professional™) accreditation is arguably one of the more difficult and expensive to obtain, and their response to Reg BI is to make their standards even more stringent, requiring that CFPs be “fiduciary-at-all-times.” They are endeavoring to make sure clients fully understand potential conflicts, fees, and investment recommendations, and that clients thoroughly comprehend the difference between comprehensive financial planning versus one-off “financial advice” so they are capable of giving informed consent (or rejection).

Industry insider, Michael Kitces, has been outspoken about the changes, and has created some excellent charts outlining CFP requirements. NOTE: Accredited CFPs can be RIAs, broker-dealers or dually-licensed. You can read more about CFP changes at kitces.com here.

Reg BI is complex and far-reaching and is still being analyzed and assessed by industry experts. SEC and FINRA clarifications may follow. The information in this article is provided for general information and educational purposes only. It is not designed nor intended to be applicable to any firm or financial professional’s individual circumstances.

Do not rely on this information for advice. Check with your attorney for precise legal information about your specific situation.

Listen to our podcast here: https://soundcloud.com/thequantumgroup/quantum-reg-bi-overview

Sources:

https://www.sec.gov/info/smallbus/secg/regulation-best-interest

https://www.sec.gov/regulation-best-interest

https://www.finra.org/rules-guidance/key-topics/regulation-best-interest

https://www.riainabox.com/blog/does-finra-regulate-registered-investment-adviser-ria-firms

https://financialadvisoriq.com/c/2733063/327873/only_registered_advisors_call_themselves_advisors

https://www.barrons.com/articles/sec-when-using-the-word-advisor-is-a-no-no-51588185296

With a degree in journalism and many years of experience, Pel creates content for websites, blog posts, social media, whitepapers, marketing pieces and more. She is passionate about SEO.