Are you doing protection-based planning in this volatile market?

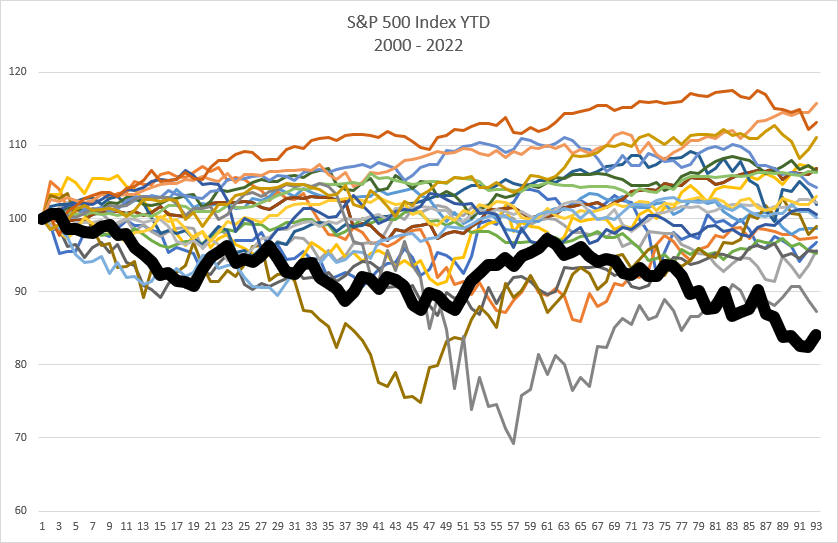

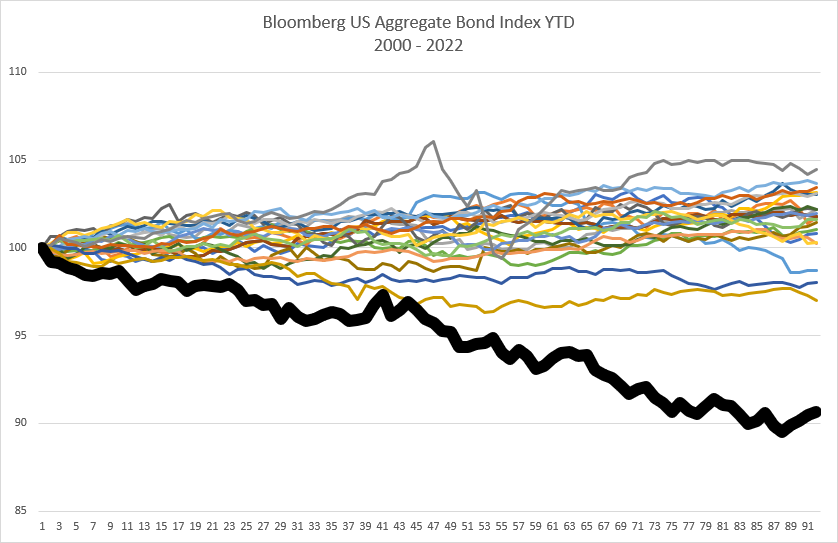

Since January 1st of 2022, the financial markets have experienced significant equity and bond market corrections. These corrections have ranged from a 14.6% decline in the S&P 500 to as much as 22% decline for the Nasdaq and an even greater correction in the bond markets. In the first quarter of 2022, all major stock and bond benchmarks saw their biggest quarterly losses in two years, resulting in the exposure of significant pain points across traditional financial planning and investment management.

The charts below tell the story. Each colored line represents the YTD returns of the S&P 500 and US Agg since 2000. The black line shows 2022 through May 15th.

As we look forward, the Fed plans to aggressively raise interest rates, which are still historically low, to combat inflation. Rising rates signal the end of a 40+ year bull market for bonds, making fixed options like bond funds and bond ETFs difficult and maybe even not investable right now due to duration risk and low distribution yields. Equity markets will continue to be volatile and the political landscape will continue to be fluid, making the overall financial markets a very difficult place to be for certain investors as we are most likely in the late stages of this remarkable and historic bull market.

Many advisors have never experienced a bear market, the last of which was 2008, let alone experienced a prolonged bear market like 2000-2003. These are the types of markets that advisors need to be aware of, as there will be another, most likely not too far in the future. If an advisor is not using protection-based planning, they may be facing the difficult conversation of telling a client they will not be able to retire on time, or even worse, that they will need to go back to work while in retirement.

So, what’s an advisor to do? That depends on the client.

Protection: The Overlooked Phase Of Client Investment

There are four stages of an investor’s lifecycle—accumulation, protection, distribution and legacy. Most advisors, probably 90% of which that are solely focused on AUM, talk about two phases of the investment lifecycle—the accumulation phase and the distribution phase. They don’t mention the stage most critical to retirement planning—the all-important five to ten years prior to retirement and the years immediately following a client’s start to retirement—the protection phase.

Traditionally, little planning goes into the protection phase. Most advisors stick to what they know—traditional stocks and bonds, your average 60/40 portfolio design with assets under management (AUM). They avoid protection-based and holistic financial planning. However, as they choose to ignore the protection phase of the investment lifecycle, they could be setting retirees up to experience similar outcomes to those we saw in the 2008 financial crisis.

Advisors need to seriously consider how they will mitigate some of the major risks in retirement like sequence of returns, longevity, lack of income and potentially higher taxes. That begins with a hard look and in-depth analysis of each of their pre-retirement portfolios. Financial advisors need to determine how each individual client will actually be able to live off of their accumulated assets for the rest of their lives—not just give each client an offhand guess about a percentage they might be able to withdraw every year—if they’re lucky.

Traditionally, protection-based planning begins five to ten years before a client wants to retire (sometimes even sooner) and up to five years after they retire. Think age 50 to 55 or so. The exact age depends on the individual and the financial plan laid out by the advisor. These critical pre-retirement and early retirement years are when a financial advisor—especially an advisor with a fiduciary duty—should begin to deleverage the portfolio by introducing non-correlated asset classes and lower volatility solutions to the portfolio. Advisors should be using this time to assess and solve for potential pain points in the upcoming retirement stage of the financial plan.

The Art Of Deleverage

It is important to understand that when deleveraging a portfolio, it is not necessarily changing a 60/40 portfolio to 70/30 or 80/20. Deleveraging a portfolio is adding alternative, non-correlated asset classes to the portfolio to potentially solve or at least mitigate some of the pain points in the financial plan to create a successful, worry-free retirement for the client.

By now you’ve probably read articles and papers by distinguished academics comparing non-correlated assets like annuities to bond funds for retirement. Experts like Wade Pfau, PhD, Yale Professor Emeritus Roger Ibbotson and Nobel-prize winner and Yale Economics Professor Robert Shiller have each run the numbers in well-researched and highly-publicized academic studies.

Most annuities are not actually invested in the market at all, although they may credit interest based on the performance of some pretty sophisticated indexes. Annuities are contracts between your client and an insurance company. Not only can annuities perform well as part of the fixed portion of client portfolios—as multiple credible studies have shown—but they can also provide you with the means of mitigating multiple retirement risks for your clients. In fact, insurance-based solutions may be the only strategies that can help mitigate the retirement risks covered in this article. There is no other asset class that I am aware of other than insurance that can shift the burden away from the client and over to a third party to mitigate retirement and portfolio risk.

Let’s examine four retirement risks that protection-based planning can help mitigate:

Sequence Of Returns Risk

Sequence of returns risk may be the greatest risk to a retirement plan. The portfolio’s returns in the years prior to retirement and immediately after the client starts retirement have the greatest impact on how retirement may look for the client. Negative returns (especially early in retirement) can endanger a client’s financial plan when they start withdrawing a percentage of their portfolio to fund their lifestyle in retirement. If there are significant portfolio losses, the withdrawal rate necessary to sustain the client’s lifestyle will ultimately need to be adjusted higher, resulting in even greater stress on the investment portfolio and ultimately putting the client at risk of running out of money. By adding a deferred or fixed indexed annuity with a guaranteed lifetime income option during protection-based planning, an advisor can help mitigate sequence of returns risk. If markets correct or even crash, not only is the principal protected for the client with these annuities, but the client can then trigger a lifetime income benefit which would be necessary for retirement to meet their estimated monthly budget. If you design the portfolio and financial plan correctly, the client won’t have to touch the balance of their portfolio until later on, and the bulk of their managed assets can remain in equities if desired. Bear or flat markets at the beginning of retirement will be a non-issue, because your client won’t be withdrawing money then. Laddering annuities like a traditional bond ladder will allow a client to trigger income during different life events, shifting the burden of income off the portfolio.

Income Risk

As mentioned above, immediate stock market losses could cause a drastic change in the retirement plan, mainly affecting income. Either the client will need to take less income using the same withdrawal rate (think 4% rule), or the client will need to increase the withdrawal rate putting more stress on the portfolio. To address income risk, not only does a deferred fixed or fixed indexed annuity mitigate sequence of returns, it can also play a major role by providing a future guaranteed retirement income stream which is protected from market loss. Other potential benefits of these non-correlated assets include:

– Income Doubled – Some products will double a client’s income for up to 60 months if there is a qualifying event for long-term care or confinement.

– Full Social Security – Some products can also help bridge the gap to get a client to full Social Security benefits by triggering the lifetime income from the annuity when income is needed before attaining full Social Security age.

– Income Plan Gap Benefits – There are even products today that will increase the client’s guaranteed income to replace a loss in expected Social Security benefits if there is ever a reduction, like most suspect will happen in 2035.

– Spousal Protection – You can help ensure that the income continues even if one partner passes away early in retirement leaving the surviving spouse with potentially lower pension or Social Security payments.

– Inflation – Some solutions offer an increase in income to combat raising inflation.

Longevity Risk

With 10,000 people in America turning 65 every day, we’re living in an era of increased longevity. While previous generations’ long-term retirement plans may have been for 10 to 15 years, now clients need to fund what could be 40 years of retirement. It’s important to start having longevity conversations early (and often)—while clients are in the pre-retirement phase—so that they can begin thinking about the financial implications and impacts of a longer life. Most annuities come with lifetime income options. If your client is healthy and lives into their late 80s, 90s or longer, this can really pay off. As a hedge for your client, annuities with a lifetime income option also have accumulation potential that should outperform bonds in the current market environment. If the client never needs the additional income, the death benefit will pass to their beneficiaries.

Higher Taxes In Retirement

Annuities aren’t the only strategy you should consider in protection-based planning. Today’s permanent life insurance policies, like whole life or indexed universal life, are designed to provide retirement benefits that can mitigate income tax increases. Not only does life insurance offer tax-free transfer of wealth to your client’s selected heirs and beneficiaries, it provides tax-free income in the form of loans that your client can use during their retirement. The policies built today can also offer long-term care benefits (in lieu of extremely expensive traditional LTC) that can add another layer of protection-based planning. Not only does life insurance help in the protection phase of an investor’s life cycle, but life insurance is critical, especially for higher net worth clients, for the fourth and final phase of the investment life cycle, legacy. A topic for another day, but too many advisors avoid this holistic planning opportunity with their clients and do not discuss life insurance as an asset class. In an economic climate rife with market volatility, where few companies offer pensions, and headlines question Social Security’s solvency, pre-retirees need safety and guarantees not provided by traditional investments and portfolio management.

It’s not just about stocks and bonds anymore. It’s incumbent upon all advisors, including advisors that claim to be fiduciaries, to help their clients address retirement risks through protection-based planning in this critical phase of the investor’s lifecycle.

Protection-based planning helps your clients succeed—and it helps you retain your clients even during rocky and unpredictable market conditions.

Read the original story here: https://www.lifehealth.com/protection-based-planning/

As a CERTIFIED FINANCIAL PLANNER™, former advisor and portfolio manager for one of the nation’s largest wirehouses, Andy understands what it is like to sit across from a client during good times, but more importantly, during bad times when markets are down.