In honor of the upcoming holiday—Halloween—we’d like to recap some survey results about the top financial fears your clients might be facing.

Overall

A recent survey by GOBankingRates1 offered 2,500 Americans a choice between seven options as their “biggest money fear.” Here are the overall results from 2017:

- 22% of Americans chose “never being able to retire” as their biggest money fear.

• 20% are most afraid of always living paycheck to paycheck.

• 18% are most afraid of living in debt forever.

• 16% are most afraid of losing their jobs.

• 11% are most afraid of losing all their money in the stock market.

• 8% are most afraid of never being able to afford a home.

• 4% are most afraid of always having a low credit score.

This is a different result from their last survey done in 2015, where they found the top overall fear to be “always living paycheck to paycheck.” (The 2015 survey also found that one in four Americans thinks about money daily.)

Gender

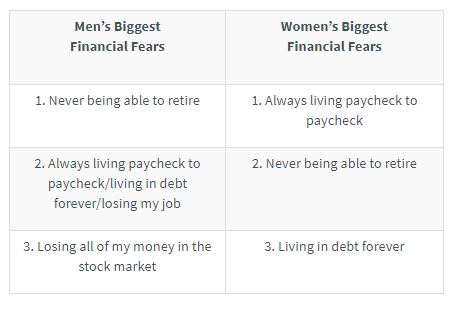

A deeper look at the 2017 survey results found gender differences, among other things. “Always living paycheck to paycheck” is still the top fear of women, followed closely by “never being able to retire.” Women are also concerned about living in debt, while men are concerned about losing their money in the stock market. Here is how the top three fears by gender compare in 2017:

Age

Age

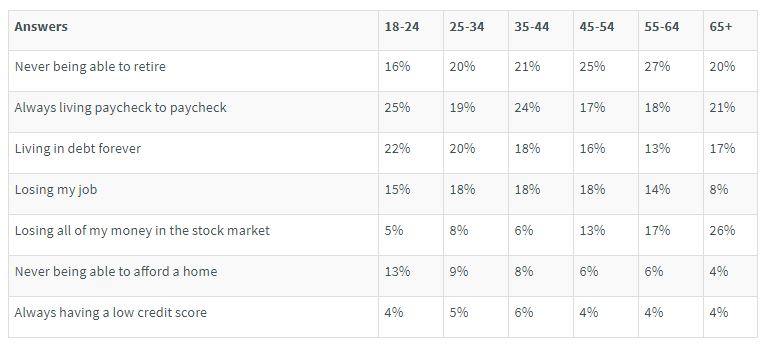

Unsurprisingly, money fears are also impacted by age. “Always living paycheck to paycheck” and “living in debt forever” sometimes exceed “never being able to retire” as the top fear among people under the age of 45. Seniors 65+ are the only age group who chose “losing all of my money in the stock market” as their greatest financial fear.

Here is how the top fears break out by age in 2017:

Financial Anxiety

Financial Anxiety

Last year, a Northwestern Mutual study2 of 2,646 American adults aged 18+ concluded that 85% of adults in the U.S. suffer from financial anxiety. And it’s getting worse; 36% say their anxiety has gone up in the last three years, and 28% worry about their finances every day. The problem is big, and affects all aspects of life. Among those feeling financial anxiety:

- 67% say it is negatively impacting their health

• 70% say it is negatively impacting their happiness

• 61% say it is negatively impacting their home life

• 70% say it is negatively impacting their moods

• 69% say it is negatively impacting their ability to pursue dreams/passions/interests

• 51% say it is negatively impacting their social life

• 41% say it is negatively impacting their career

What People Want

Perhaps the most interesting part of Northwestern’s survey was what people said about financial security. When asked for the single most important benefit that financial security would bring them, 52% answered “peace of mind that I never have to worry about day-to-day expenses.” This was more than double the second most popular answer “the flexibility to live a desired lifestyle” chosen by 22%, while only 8% answered “freedom to pursue my dreams.”

If people suddenly had the financial certainty to allow them to live their lives differently, here is what they said they would do:

- 34% would relocate or buy a home

• 32% would leave money to loved ones to help them feel financial secure

• 29% would work on their own personal health and well-being

• 29% would pursue a dream or passion

• 15% would stop working altogether

• 12% would purchase luxury items like a boat, car or second home

• Only 9% said they would change careers

The Opportunity

As a financial advisor, your expertise is critical. You can help Americans turn their financial fears into positive feelings of security and peace of mind. Clearly you can help people 55 or older with financial investments that are not subject to stock market risk. And you can help all ages get on an achievable road to future retirement.

For help with allaying client fears and developing strategies based on individual client parameters, call Quantum at 800.440.1088

FOR FINANCIAL PROFESSIONAL USE ONLY – NOT FOR USE WITH THE PUBLIC

Sources:

1 GOBankingRates, “Survey Reveals Americans’ Biggest Money Fears in 2017.” Gobankingrates.com. https://www.gobankingrates.com/investing/survey-reveals-americans-biggest-money-fears-2017/ (accessed October 18, 2017).

2 Northwestern Mutual Newsroom, “Planning & Progress Study 2016.” News.northwesternmutual.com. http://news.northwesternmutual.com/planning-and-progress-study-2016 (accessed October 18, 2017).